Speak to our experts, today.

Get simple software and tech-enabled Third Party Services, faster than ever before.

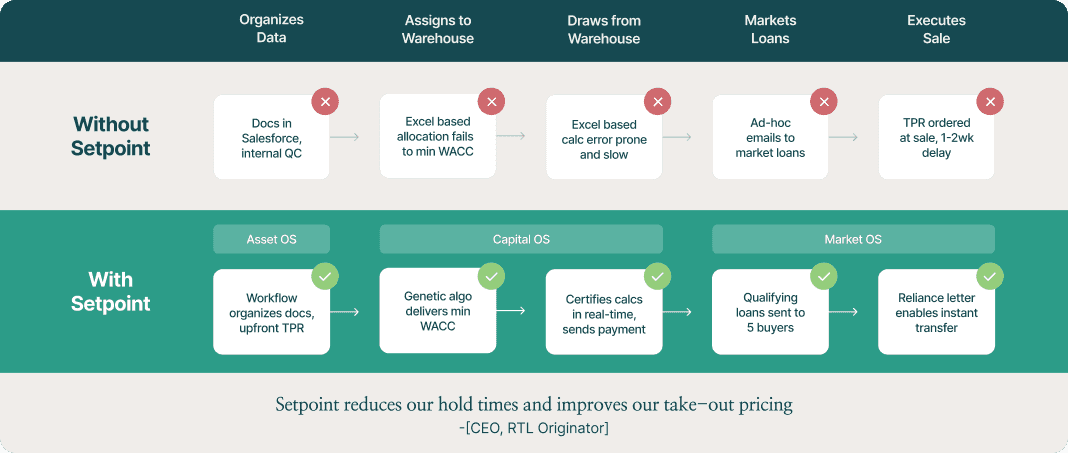

Capital markets teams need accurate collateral and performance data. Most teams push and pull data between internal systems, CRMs, LOSs and servicers. Manual processes and errors are common.

Setpoint connects these disparate sources and organizes data and documents. We also push clean data and document feeds to our customer’s internal systems. Setpoint’s AssetOS organizes, verifies and stores data and documents, often becoming our customer’s single source of truth.

During setup, Setpoint will identify key sources of data and frequency requirements. We ingest data in three ways: (1) file uploads (CSV or excel), (2) product integrations and (3) custom API integration. File uploads are preferred; most systems support this approach with little or no development work. Setpoint also supports integrations with Salesforce, Box, Dropbox, Yardi and Encompass. Finally, when needed, Setpoint can support integration with our API. Setpoint uses the same three methods to push data to internal systems, cloud storage and service providers.

Before hiring Setpoint, one of our Proptech customers maintained data in Salesforce, Encompass, a custom-built internal system and Box. The team manually uploaded and downloaded data between systems and created Box folders for every document.

Setpoint connected to all key data sources for Proptech Co, including their internal system, Salesforce and Encompass. Proptech Co. uses Setpoint’s Collateral manager to organize their data and documents, prepare assets for funding, and to push data back to their internal system.

Proptech Co. estimates that Setpoint reduced their funding time by 3 days, improved data accuracy, and eliminated situations where assets needed to be funded with equity.

Ready to streamline your funding operations? Reach out to our sales team at sales@setpoint.io.

Get simple software and tech-enabled Third Party Services, faster than ever before.