Speak to our experts, today.

Get simple software and tech-enabled Third Party Services, faster than ever before.

In our last piece in the series, we delved into the “build vs. buy” decision for technology solutions in asset-backed financing. Now, assuming you made the smart decision to buy, how should you approach evaluating potential tech providers?

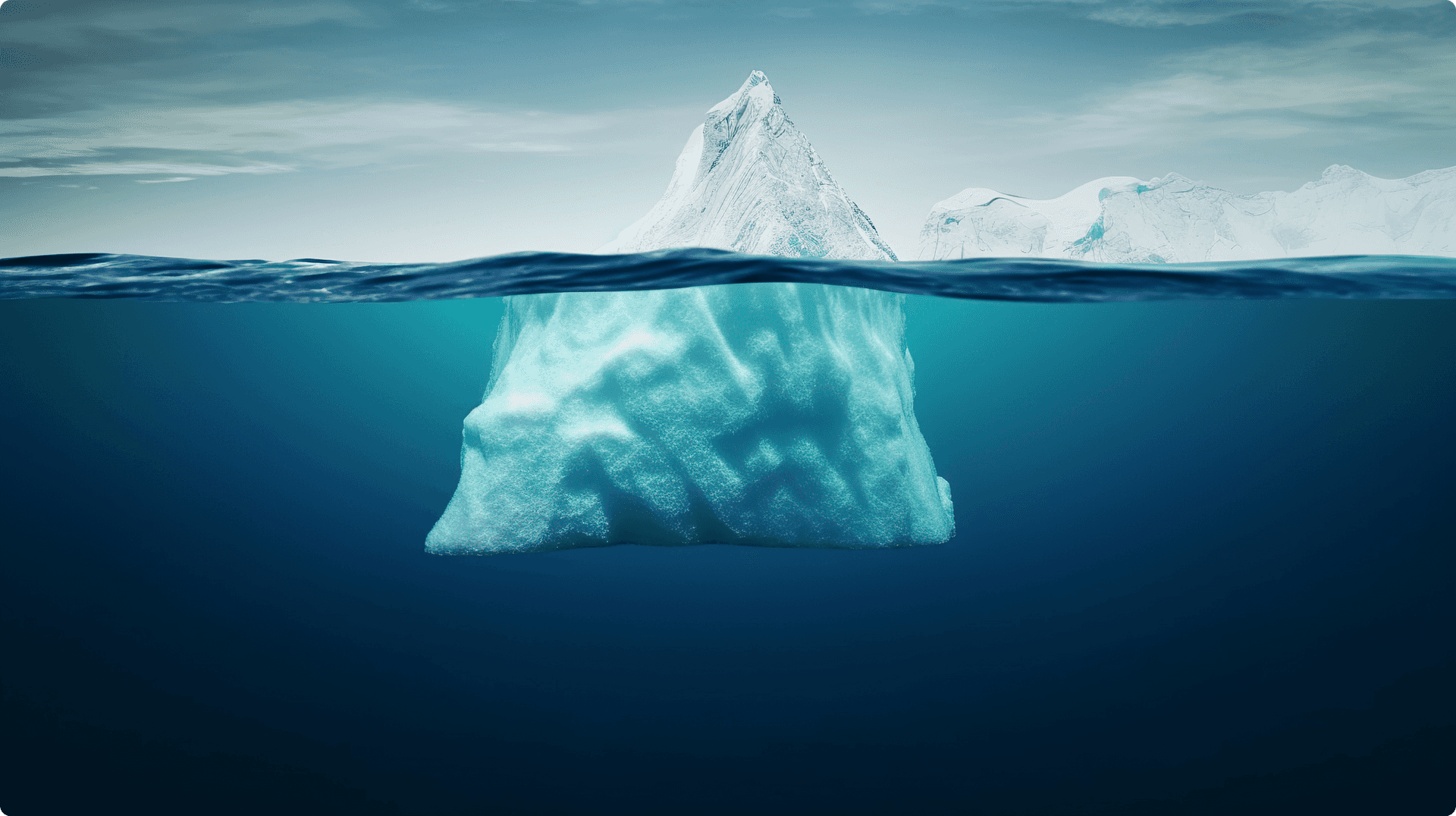

Choosing the right tech provider is crucial. Many providers may appear robust, but scratch beneath the surface and you might find limitations that could impact your growth. It’s essential to confirm that the provider can understand the nuances of your business model. Does it have proven expertise in your asset class, related leverage structures and workstreams relevant to your operations. As you are making this decision with an eye to future growth and scalability, beware: some providers rely on outdated Excel-based calculations to deliver their solution, presenting only a polished front-end. This lack of depth could severely hamper your ability to scale and adapt to more complex financing structures.

Your business is not static, and neither should your tech solution. If your future plans involve expanding into new types of asset classes or introducing more complex debt instruments like multi-tranche securitizations, your tech provider should not only understand these structures but also support them. The market is evolving, and many tech providers only support basic, uni-tranche structures—adequate for some, but potentially restrictive as you grow.

A provider’s financial stability and commitment to innovation are as crucial as their technical capabilities. Assess their financial health, investment in new technologies, and the strength and quality of their investor backing. A valuable tech partner has the resources to commit to constant innovation— investing in and regularly releasing updates to their platform to keep you at the forefront of industry developments. This dedication to improvement ensures that your operations remain competitive and adaptable in a rapidly evolving market. This is not just about ensuring they have the resources to support you today, but also about their capacity to be a contributor to growing and innovating your business.

The onboarding process is often telling of a provider’s operational expertise. A reputable tech partner will have a deep understanding of the capital markets and exhibit a strong ability to integrate their solutions with your operations seamlessly. They should offer more than just technology; they should provide a partnership that enhances your operational efficiencies and overall strategy.

Consider how the tech provider has impacted other clients. Have they significantly reduced errors in borrowing base reports? Shortened collateral review times? These metrics are vital. They reflect not just the provider’s ability to enhance operational efficiency but also to reduce costs and improve your standing with lenders.

Selecting a tech partner is a strategic decision that extends beyond the technical needs of today. It involves choosing a partner who will contribute to your company’s growth and adaptability for years to come.

Get simple software and tech-enabled Third Party Services, faster than ever before.