The Challenge

Scaling Capital Markets, Without Scaling Headcount

As a pioneer in embedded capital products, Fundbox has helped over 150,000 small businesses unlock more than $6 billion in credit. Their growth as a capital infrastructure provider—powering everything from SMB lending to embedded finance—has brought increasing scale and complexity to their own funding operations.

As they prepared for their first ABS deal and expanded into whole loan sales, the capital markets team had a decision to make: continue managing allocations and reporting manually, or invest in infrastructure that could scale with the business.

“We were allocating loans across warehouse facilities using fairly crude rules,” says Braham Mehta, Head of Capital Markets and Corporate Development. “Any time we amended or renewed a facility, we had to go back to engineering to retool the structure. It wasn’t scalable.”

Even with just a few warehouse lines, monthly reporting already took half a day across two team members. As complexity grew, so would risk—of delays, errors, and team burnout.

“Borrowing base reporting is probably the most boring element of capital markets,” Mehta adds. “I didn’t want to subject anyone to running it full time.”

The Challenge

Scaling Capital Markets, Without Scaling Headcount

As a pioneer in embedded capital products, Fundbox has helped over 150,000 small businesses unlock more than $6 billion in credit. Their growth as a capital infrastructure provider—powering everything from SMB lending to embedded finance—has brought increasing scale and complexity to their own funding operations.

As they prepared for their first ABS deal and expanded into whole loan sales, the capital markets team had a decision to make: continue managing allocations and reporting manually, or invest in infrastructure that could scale with the business.

“We were allocating loans across warehouse facilities using fairly crude rules,” says Braham Mehta, Head of Capital Markets and Corporate Development. “Any time we amended or renewed a facility, we had to go back to engineering to retool the structure. It wasn’t scalable.”

Even with just a few warehouse lines, monthly reporting already took half a day across two team members. As complexity grew, so would risk—of delays, errors, and team burnout.

“Borrowing base reporting is probably the most boring element of capital markets,” Mehta adds. “I didn’t want to subject anyone to running it full time.”

The Solution

Why Fundbox Chose Setpoint

As Fundbox looked to scale its capital markets infrastructure, the team evaluated a range of technology partners. “We ran a process across five or six providers,” says Braham. “Setpoint stood out. We wanted quick implementation, reasonable cost, and a solid team. A few providers had the first two—Setpoint had all three. Especially the team’s structured credit experience. That made a huge difference.”

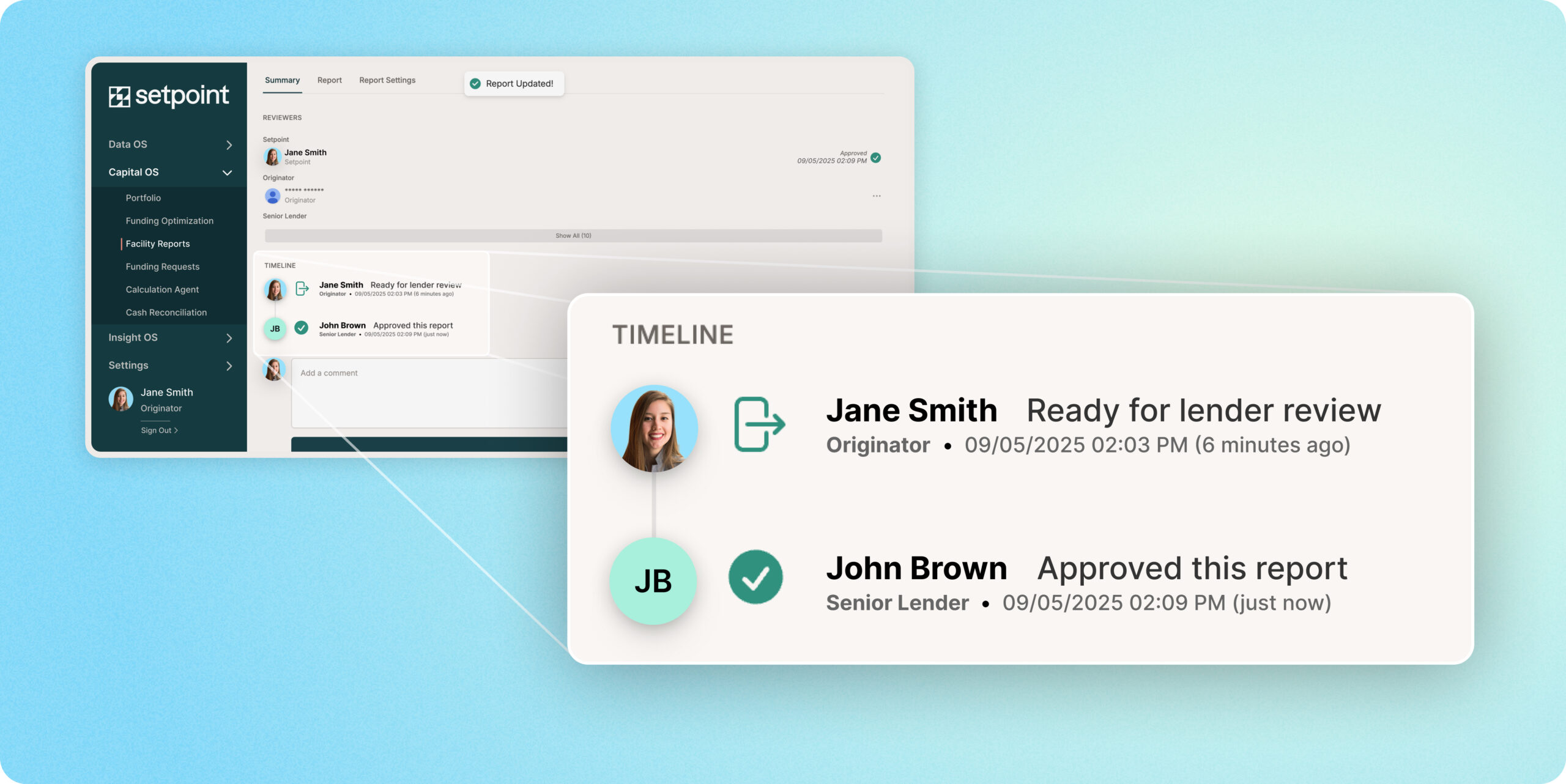

Setpoint now powers Fundbox’s full warehouse operations—from daily asset allocations to monthly servicer reporting.

“Setpoint became a full-circle solution. We upload loan tapes, they optimize allocations, run reports, and return outputs—without us having to build or maintain any of the infrastructure.”

Key capabilities include:

- Funding Optimization: “They built a really cool optimization framework that runs through every possible scenario and lets us switch between leverage or cost of capital as objectives—while staying within our deal docs.”

- Daily Tape Ingestion and Output: “Every day we upload a loan tape. Setpoint allocates assets and outputs which SPVs loans are pledged to, so we can route cash correctly.”

- Dual-Sided Platform with Lender: “We got Cross River Bank onboarded. They now see reports in-app, handle exceptions, and align funding timing—all without back-and-forth emails.”

The Result

Unlocking Efficiency Where it Matters

Setpoint delivered immediate time savings—and longer-term capital efficiency for Fundbox.

- 50%+ reduction in reporting time: “We were spending a day or more on borrowing base and reporting. Now it’s a quick review to sense-check numbers—everything else runs automatically.”

- 2–3 percentage point increase in debt drawn: “We’re pledging loans more optimally across facilities, improving leverage and warehouse utilization.”

- No new headcount required: “Our engineers don’t have to build or maintain code for capital markets infrastructure. They can stay focused on revenue-driving products.”

- Future-proof scalability: “We can bring on new facilities or structures without rebuilding logic every time.”

A New Operating Rhythm

For a tech-forward company like Fundbox, the default instinct was to build everything in-house. But Setpoint shifted that mindset.

“Setpoint changed how I think about vendor solutions,” Mehta says. “We’re a tech-forward company. Our instinct was to build everything in-house. But capital markets infrastructure is easy to deprioritize—and hard to get right.”

What ultimately made the difference was finding a partner who could speak the language of structured credit and move at the speed of their team.

“Having a team that speaks the language of structured credit and automates this work lets us move faster, with more confidence, and without growing headcount.”

Today, Fundbox continues to expand its partnership with Setpoint. “I’d recommend Setpoint to any capital markets team looking to scale efficiently,” Mehta adds. “The integration was the smoothest I’ve seen—and the product just works.”