The operating system for capital markets.

Setpoint embeds with borrowers and lenders to enhance debt facility management.

Warehouse Facilities

Forward Flow

Securitization Management

Leverage and Fund Finance

Fast

Get up and running on Setpoint quickly, with zero lift from your team. Once live, enjoy reduced funding times and seamless operations.

Easy

Always experience a white-glove onboarding. We establish the right processes at closing or ensure a seamless transition mid-transaction.

Efficient

Our Capital Solutions team brings the expertise, letting you focus on growth and your business.

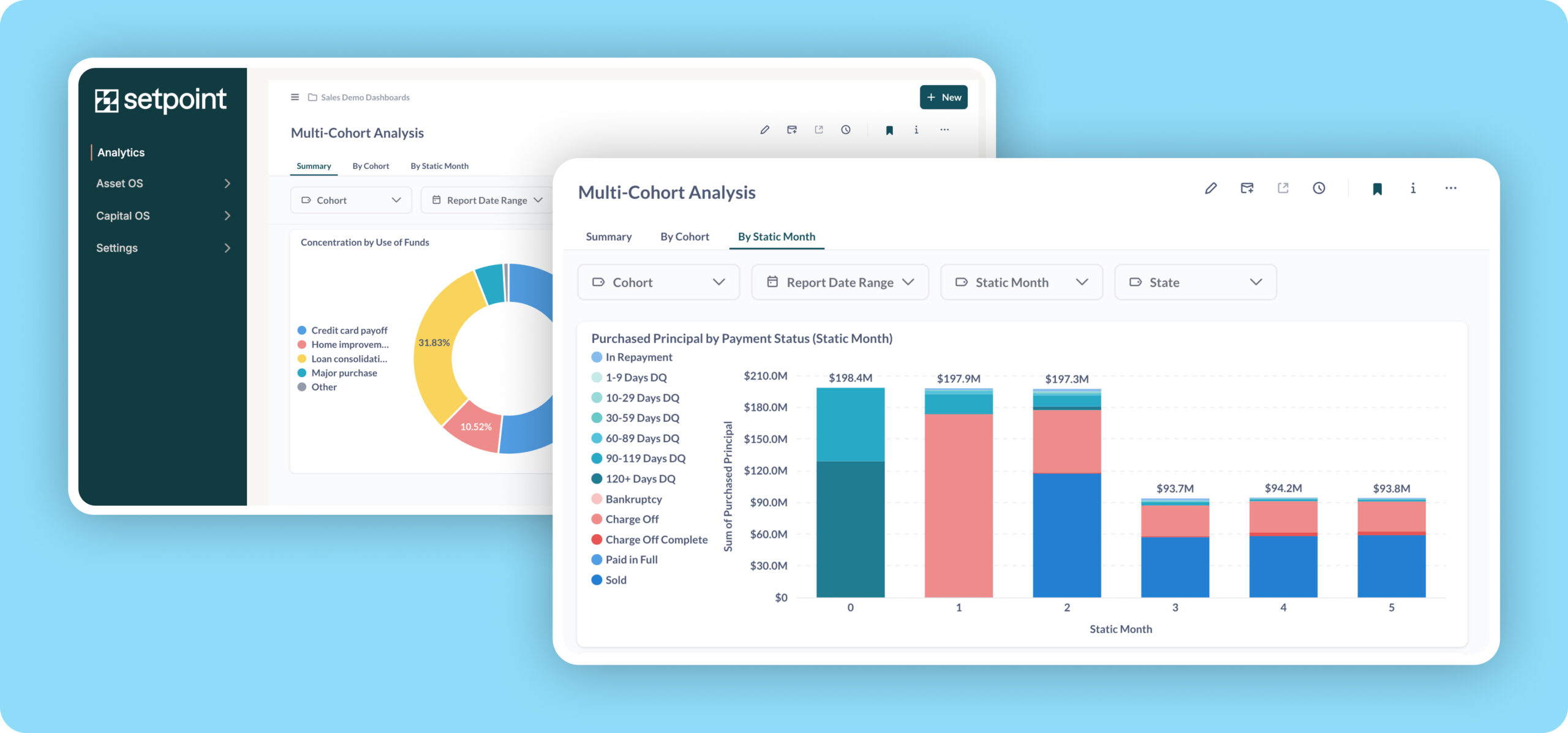

The capital markets OS.

Over $50 billion in financed assets are powered by Setpoint’s technology annually across ABS and ABF markets.

Innovative capital teams run on Setpoint.

Debt Capital

Fund intraday, automate borrowing requests & reporting, optimize pledging, and forecast lender compliance.

Securitized Products

Automate investor reporting, asset & collateral management workflows, and select optimal static pools to securitize.

Equity Capital

Allocate efficiently based on acquisition partner requirements, originate based on funding capacity, and forecast portfolio performance.

Institutional Lenders

Standardize borrower data, reconcile calcs, and manage your entire ABL portfolio. Access real time analytics and track loan-level data.

Asset Managers

Leverage our asset modelling tools to underwrite new loans, project IRR/MOIC, and manage credit lines.

Private Credit

Access our software to manage funding operations and centralize all borrower activity in a single platform.

Setpoint is the new standard for all asset classes.

Resources from Setpoint.

Speak to our experts, today.

Get simple software and tech-enabled Third Party Services, faster than ever before.