Standardize borrower data and reporting, verify calculations, and ensure compliance with Setpoint. With no extra work from your team.

Accelerate capital deployment and reduce borrower risk instantly.

Structure borrower data

Turn inconsistent borrower data into standardized, structured data tapes.

Automate calculations & funding

Ensure accurate funding calculations and deploy capital faster.

Monitor & forecast ROI

View vintages, projections, and current exposure in one place.

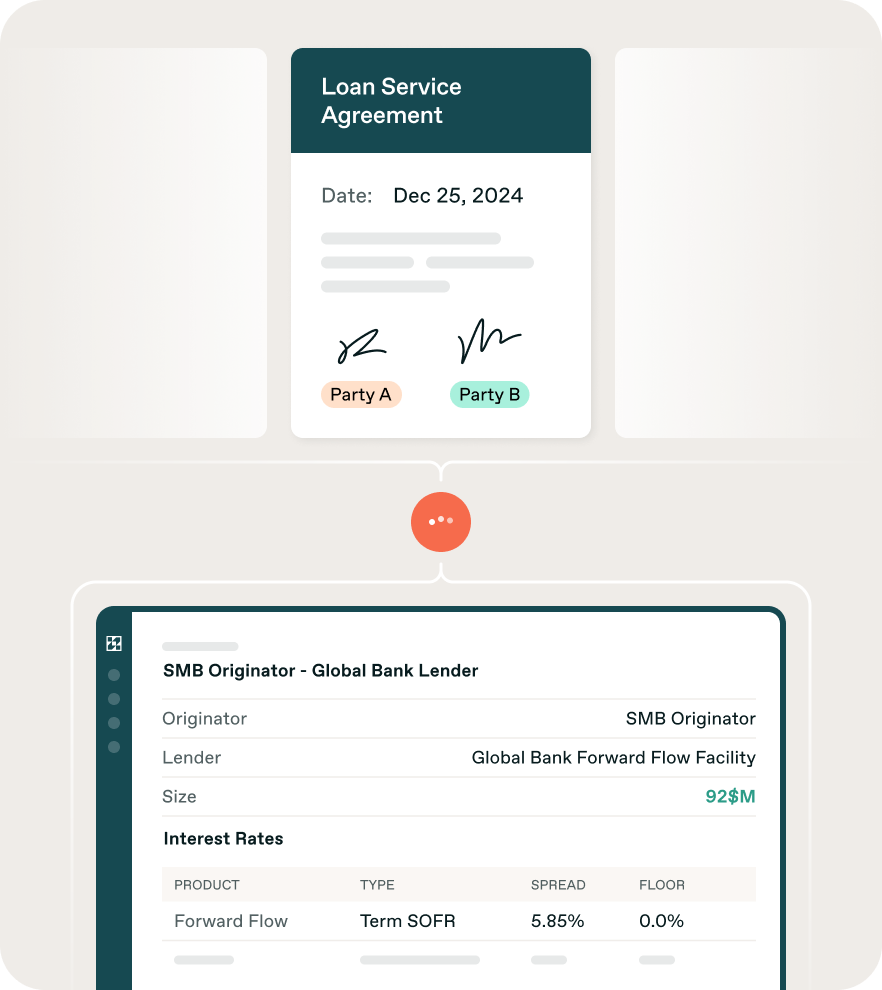

Here’s how it works.

Start optimizing your capital, with zero lift needed from your engineering teams.

01

Digitize Credit Agreements

02

Standardize & centralize data

03

Optimize your portfolio

04

Automate funding, reporting & compliance

05

Integrate Third Party Services

Trusted by all types of capital providers.

Institutional Lenders

Standardize borrower data, reconcile cals, and manage 100 lines across ABL. Access real time analytics and track loan-level data.

Asset Managers

Leverage our asset modelling tools to underwrite new loans, project IRR/MOIC, and manage credit lines.

Private Credit

White label our software to manage funding operations and centralize all borrower activity in a single platform.

Resources from Setpoint.

Speak to our experts, today.

Get simple software and tech-enabled Third Party Services, faster than ever before.